At about 5 pm EST (time varies with some brokers) if you are holding an open position overnight your account is either credited, or debited, an interest charge on the full size of your open positions, depending on your established margin and position in the market. Depending on the interest rate differential, you may pay or receive interest fees, also known as rollover fees.

This interest rate is called rollover in Forex. Why does this interest credit or debit occur? Can you avoid swap rates? Learn what is a swap rate in Forex.

The rollover happens when an open position from one value date (settlement date) is rolled over into the next value date. Rollover transactions are carried out automatically by your broker if you hold an open position past the change in value date.

Behind the scenes, the settlement occurs in two business days. Thus, if it is Monday before 5PM currencies are trading for value on Wednesday. After 5PM on Monday the trade date becomes Tuesday and they are traded for value on Thursday.Note

Rollover applies to Positions Open past 5 PM EST

Rollovers are applied to open positions after 5 pm EST change in value date, or settlement date. They are NOT applied if you don’t carry your position over the change in value date; thus, if you open and close your trade before 5 pm you will never incur rollover charge or debit.

Wednesday carries a 3-day rollover

On 5PM EST on Wednesday the value date changes from Friday to Monday, a weekend rollover, which means a three day rollover (Saturday, Sunday, Monday), which means that the rollover costs/gains are going to be three times as much as any other day.

Why does this interest credit or debit occur?

Because when you are trading currencies, you are trading cash. When you go long on a currency, it is like holding a deposit at a bank, and you would expect to earn interest on your deposit, and when you go short on a currency, it is like borrowing, and you would expect to pay interest on the loan. The likeness becomes more complicated because with a currency pair, you are holding one currency with a positive balance (the currency you are long) and one with a negative balance (the currency you are short), and the difference between the interest rates of the two countries is called the interest-rate differential.

Whether you are credited or debited depends on two factors: 1) whether you are holding a long or short position; and 2) the interest rate differential between the two currencies in the pair you are trading.

Since every currency trade involves borrowing one currency to buy another, interest rollover charges are part of Forex trading. Interest is paid on the currency that is borrowed, and earned on the one that is bought. In effect, you earn or pay interest depending on the direction of your position. If you are buying a currency with a higher interest rate than the one you are borrowing, the net differential will be positive (i.e. AUD/USD) – and you will earn funds (be credited) as a result. If you are selling a currency with a higher interest rate than the one you are borrowing, the net differential will be negative, and you will end up paying (be debited) for that rollover. The Rollover costs/credits are based on your position size, with the larger the position, the larger the cost or gain to you.

How does one find out the interest rates of different countries?

There is one place to look on the web: www.fxstreet.com/economic-calendar/world-interest-rates

For instance, the above website presents the interest rates in an easy to read table like the one below (accurate as of June 2020):

From the chart above, you can gather that the Australian rate of 0.25% is significantly greater than the slim 0.0% of the EU ECB. For investors, this would mean that one would earn more interest in being long Australian dollars and being short the EUR (i.e., long AUD/EUR).

How do you calculate the rollover rate of a particular currency pair (in General)?

Bear in mind that rollover transactions are carried out automatically by your forex broker if you hold a position past the change in value date.

However, for various reasons, you might like to know the calculation behind the scenes.

Here is the rollover calculation formula:Contract notional value x (base currency interest rate – quote currency interest rate) / 365 days per year x current base currency rate = daily rollover interest debit/credit

Example of Rollover Calculated in USD:

You buy 1 lot AUD/USD while AUD/USD price at rollover time is 1.0486. How much swap should you pay/receive at 5 PM EST?

AUD/USD price at 5:00 PM EST: 1.0486

Australia Borrow Rate= 4.75% per annum

US Lend Rate = 0.25% per annum

Therefore: $100,000 * (4.75% – 0.25%) / 365 * 1.0486

Further: $100,000 * 4.50% / 382.74 = 11.75 per day

That was just an example and swap can change on a daily basis.

Note: We use 365 because the interest rate shown is paid over a daily basis. Since our trader only kept the position open one day, we have to divide it by 365.

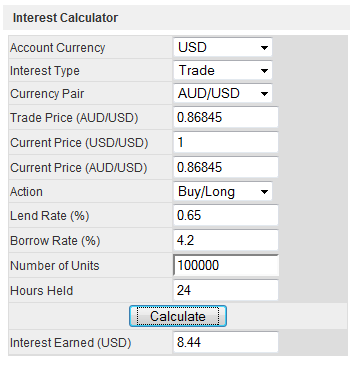

If you want a cool calculator to help you calculate the current potential positive or negative rollover you might be charged if you were to carry a position over a number of days, you can use the Oanda interest calculator.

The snapshot of this calculator is below:

You always want to indicate the hours held to be greater than 24 to fully appreciate the rollover calculation.

Note: this calculation gives you a good idea of current rollover rate of a currency pair you are long or short, but it is particular to Oanda’s own rates. To know the current rollover rate of your particular brokerage, you can use the tools below.

Quick Way to See Overnight Interest of Any Pair of Any Broker

If you want to know the rollover rate of your individual currency pair, some forex platforms such as FXCM’s TradeStation publish these particular rates. However, if you are working with an MT4 platform, you can apply the following two MT4 information indicators to your chart:

| Indicator | Descriptor |

|---|---|

| StatMonitor_1.1-Phat | Displays Spread, Buy/Sell Swap, Volume of chart symbol |

| Display Info All Pairs | Author: Hanover. Displays valuable information on multiple pairs: Pair Abbreviation [Column1], Bid Price [Column2], Ratio of Day Range to Average Daily Range (also as a %) [Column3-5], Spread ( also as % of ADR) [Column6-7], Pip Value [Column8], Buy Swap Rate[Column9], Sell Swap Rate [Column10]. |

A picture of both these handy indicators applied to the AUDUSD chart of FXPro looks like this:

The first indicator, StatsMonitor_1.1Phat.mq4, displays a spread of 20 (which is 2.0 pips because it is 5 digit broker), a buy swap of 14.83 and a sell swap of 17.06. Thus on any normal rollover day, except for Wednesday, you would receive a credit of $14.83 for being long 100,000 standard position of AUD/USD if you held it past the rollover time, and you would receive a deduction of $17.06 for being short 100,000 standard position of AUD/USD. The second indicator, Display Info All Pairs. ex4, displays bid price, average daily range, spread, pip value and buy/sell swap information on a multiplicity of pairs, saving you much time in trying to discover this information piece by piece, pair by pair. At a glance, you can quickly see that AUD/USD has a much higher swap rate than the others, which would be useful information for anyone thinking about what could be the next carry trade.

Why are the negative swap rates much higher than the positive swap rates?

In an ideal world, the positive and negative swap rate should be an equal rate (that is, in the illustration above, both the positive and negative swap of AUD/USD should be 14.83), but instead, the negative swap rate usually appears much greater than the positive swap rate. This is probably not fair but it is the way the brokerage game is set up. If your trading history were to present an equal number of longs and shorts carried out over more than 1 day, you would probably have an overall negative swap charged on the total of all your trades. It may not come out to much but it is something you have to end up factoring as a cost of trading.

You may also discover that some brokers will incur a negative swap rate for being either long or short a currency pair. If you see a broker doing this, you might want to reconsider having an account with him.

How can you avoid paying swap rates?

There are at least three ways you can avoid paying swap rates.

1. Trade in Direction of Positive Interest.

You can go trade only in the direction of the currency that gives positive swap. This is generally not recommended unless trading in that specific direction has been the most favorable direction in terms of back-tested and forward testing trading results.

2. Trade only Intraday and Close Positions by 5:00 PM.

You would avoid the swap because you are in and out before rollover time. However, you should not decide to become an intraday trader because of the swap. The only reason that can make you become an intraday trader should be your strategy and your performance results rely on being intraday. Not because of the swap.

3. Open up a Swap Free Islamic Account, Offered by Some Brokers.

This is an option offered to Muslim customers, though in reality non-Muslims frequently choose the category if offered. These particular accounts are run in full compliance with Islamic beliefs and the policy of no interest to be paid upon business transactions. If you believe you will be having many overnight transactions, you might consider opening a swap free Islamic account.