Leverage represents a margin trading ratio, and in forex, this can be very high, sometimes as much as 400:1, which means that a margin deposit of just $1000 could control a position size of $400,000. Leverage has a direct effect on the capital in your trading account. Learn what is leverage in Forex and how to use it safely in your FX trading.

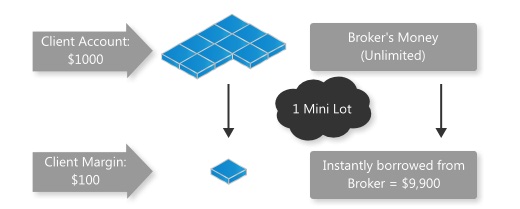

If you were given 100:1 leverage brokerage account, and you had a mini account with $1000 (1000 units), you could enter $100 (100 units) of that account into the market on margin and trade a $10,000 (10,000) unit position. For every $1 put into the market on margin your broker adds another $99 to make it $100. This means you can trade mini lots worth $10,000 using an account funded with only $100 or more.

Leverage 1:100 allows the client to put up 1 part for each 100 of the trade: in the example above, client contributes $100 and the rest ($9,900) comes from the broker.Note: Broker leverage does not change the value of lot!

Leverage does not affect the value of the lot: a mini lot is 10,000 units and a standard lot is 100,000 units, regardless of the leverage. Instead, leverage has an effect on the number of lots you can have in the market, based on the capital in your account.

In contrast to stock markets where you require the full deposit of the amount traded, the Forex market only requires a margin deposit. The rest of the amount will be granted by your broker (you will borrow it from your broker). Stocks can let you borrow from your broker on margin to, but only with 2:1 leverage, and futures can grant much greater leverage (up to 30:1) but with a fixed contract size that dramatically decreases flexibility.

Forex, in contrast, allows the possibility to use greater leverage (up to 400:1) with the added bonus of using varying lot sizes. All transactions can be conducted via standard, mini, micro or sometimes as low as nano or penny size. Each lot size accounts for a different measure of units of the base currency, which in turn presents a different pip value. Below is a simple chart to show the differences in lot sizes, measured in units, volume for the major pairs where the quote currency is USD (ex. EURUSD or GBPUSD).

| Lot Size | Units of Base Currency | Volume | Pip Value (USD) |

|---|---|---|---|

| 1 Standard Lot | 100,000 units | 1.0 | 1 pip = $10 |

| 1 Mini Lot | 10,000 units | 0.1 | 1 pip = $1 |

| 1 Micro Lot | 1,000 units | 0.01 | 1 pip = $0.10 |

| 1 Nano Lot | 100 units | 0.001 | 1 pip = $0.01 |

Now, what gets interesting is the matching of this wide range of lot sizes with a wide range of leverage.

The table below illustrates the leverage type, percentage on margin needed to open up one lot, and resulting dollar amount required to open one lot (standard, mini, micro and nano):

| Leverage / Margin Requirement Table for Various Lot Sizes | |||||

| Leverage | % of margin needed to open 1 lot | $ Amount (Margin) Required for 1 standard lot ($100,000) | $ Amount (Margin) Required for 1 mini lot ($10,000) | $ Amount (Margin) Required for 1 micro lot ($1,000) | $ Amount (Margin) Required for 1 Nano lot ($100) |

|---|---|---|---|---|---|

| 25:1 | 4% | $4000 | $400 | $40 | $4 |

| 50:1 | 2% | $2000 | $200 | $20 | $2 |

| 100:1 | 1% | $1000 | $100 | $10 | $1 |

| 200:1 | 0.50% | $500 | $50 | $5 | $0.50 |

| 400:1 | 0.25% | $250 | $25 | $2.5 | $0.25 |

You can see from the chart above that with a 100:1 leveraged broker you are only required to put up $10 for each ($1000) micro lot. This means that if you had just $200 in your account, you would have the capacity to trade up to up to 20 micro lot positions, if you so desire.

But Don’t BE GREEDY!

It is not recommended you trade even 10% of your allotted margin ratio in single or aggregate lot positions. Smart leverage, as we shall see, is more in the lines of 2:1 leverage, or 2% of your free margin.

For instance, if you had a micro account of $1000, at 100:1 leverage, it would be best if you trade only 2 micro lots (2:1 leverage, or 2% of free margin). This would leave you 98% free (“unused or available margin”) to place your trades. Each pip would alter your account by 20 cents (2 micro lots X 10 cents). Furthermore, it is probably a good rule to risk no more than 2% on one trade. Putting a 100 pip stop loss on your 2 micro lot trade would mean that you would risk a maximum of 2% (100X20 cents = $20, which is 2% of $1000). This would allow you to survive a string of losses, which is a typical scenario in forex.

Leverage can be your friend or foe, depending on how you use it. Leverage is like a great trading tool, allowing traders with less capital to participate in markets that they couldn’t trade otherwise, but like any tool (think of a chainsaw), you have to learn how to use it properly or it can cut you down.

Professional Money Management: No more than 2:1 leverage per trade

Professional traders generally trade with 2:1 leverage, and you should consider this. An experienced professional advisor once said: I trade with no greater than 1:1 leverage. Through painful experience I have noticed that even the best of strategies can find themselves caught in whipsaw market lasting for an unexpected period of time that can cut them up (stop them out) on both sides of the market, resulting in an unexpected series of losing trades. I have learned to be on guard for such an event through lowering my leverage to zero leverage, or 1:1 leverage, in order to withstand the inevitable 25 trade losing streak.

One must have the foresight to use minimal leverage, along with the discipline to keep stops in place at all times, in order to increase trader’s longevity in this difficult market. Leverage can work for you if you know what you are doing, otherwise losses can accrue faster than on an unleveraged trading position.

What would be the potential risk and Reward of choosing a broker offering higher leverage than another?

Most articles discussing leverage and forex warn against brokerage firms offering leverage ratios greater than 100:1. What is behind these warnings? It is often the implicit view that the typical retail client is a greedy dumb ignoramus who will probably max out the leverage potential, if given the chance. The leverage, in this case, is like rope, and when the client is given enough of it, he hangs himself upon it. He sees that his 400:1 broker will allow him to trade 100,000 units with his $300 account size, and so he takes advantage of that allowance, overleveraging his little account to a quick death.

The overprotective US government (via the arm of the CFTC) likewise thinks that the typical client is a greedy dumb ignoramus and so in 2010 it acted to protect the forex investor from himself by forcing all US brokerages to comply with a maximum leverage of 50:1, a rule that went into effect in October 2010. Patronizingly enough, the CFTC wanted to reduce leverage to 10:1 to take the “gambler” out of forex, but in the end decided that 50:1 was more “reasonable” and more in line with Japan’s leverage regarding forex. Before 2010, it used to be that US brokers could offer leverages of 100:1 or 200:1. Not anymore. Now the US restrict leverage to 50:1 and Japan restrict leverage to 25:1, while most other countries have higher leverage.

Overall, I think that restricting the choices of US traders is very bad business and not competitive with the rest of the world. Many formerly US retail traders have ended up moving their accounts overseas to enjoy forex without as many restrictions. The Brits or Aussies or Swiss will not be so quick to shoot themselves in the foot when by NOT following the U.S. they can generate millions in additional income. This limitation in US leverage is just one of many limitations (e.g., the non-hedging rule), that did nothing to help traders and did more to restrict their ability to earn more in the U.S. It is self-righteous, patronizing and paternalistic arrogance on the part of US government regulators to think that 50:1 leverage is “good enough” for the average forex trader.

The real truth of the matter is that high brokerage leverage in and of itself is not dangerous. Because forex leverage does not change the value of the lot, and you have a choice to trade different lot sizes, it is not necessarily more risky to have more leverage, as it would be with futures, where you cannot change the lot size. Higher leverage just confers the ability to trade larger lots (or more lots) with less capital. If you had only $500, for instance, you can open up a micro account with 400:1 leverage, so that you can control up to 20 micro lots with only $2.5 margin for each. Or, you can control 1 micro lot with just a $2.5 margin. In between your minimum and maximum use of leverage and lot sizing is a vast range of flexibility.

Having more potential for leverage can be dangerous for greedy traders, but every greedy trader should have a chance to hang himself and remove himself from the marketplace. If a greedy trader has $1000 in his 400:1 micro account, and he wants to use the maximum possible leverage for his trade, he can open 3 standard lots on his account (with a used margin of $750), and gamble his way to a quick death. A very small 30 pip move against his position would cost him $900 (30 X$10 per pip X 3 lots), and at that he would automatically receive a margin call that would liquidate his 3 standard lots because he no longer had the required margin to control them.

Thus, it is worth taking note of the often repeated warning: HIGH LEVERAGE CAN LEAD TO SUBSTANTIAL LOSSES AS WELL AS SUBSTANTIAL PROFITS. Yes, especially for dumb, greedy traders who use too much of the leverage available to them.

Trading with Less Per Trade Leverage while Reserving the Right to Higher Leverage

I believe that the flexible leverage AND flexible lot sizing conferred by Forex can allow most traders a far safer trading arena than either stocks or futures. A futures trader must use the leverage geared for the contract specified, which can be quite high and dangerous. A Forex trader, in contrast, can safely trade lots and leverage in proportion to his account size. For instance, a safe starting trade size for an opening account of $1000 would probably be a micro lot, which would effectively be using zero leverage. He would then not have to worry about a 100 pip move decimating his account; instead, 100 pips against him would only cost him $10 (or 1% of his account), and he could ride out a number of losing trades.

Such a trader can then reserve the potential 200:1 leverage for diversification, opportunity or emergency. Let us go over each one. By diversification, we mean the potential to have concurrent trades that employ different strategies on different markets. Perhaps you created or found six distinct EAs that have great results in back and forward testing, and you want to have the ability to trade all six EAs, using 2% of free margin for each. By opportunity, I mean that there may be times in the market when you discover an amazing opportunity and you want to capitalize on it with greater leverage or more positions. If you think that the odds are greatly in your favor, the leverage is there for you to use. You have the potential to strike big and hard.

Then there are cases of hardship. You have suffered a huge series of losing trades, and your account is down $500 from its initial $1000 (50% loss), well then in that case you can still continue to use 0.01 lot sizes to get you out of the hole, but your leverage has grown in the interim, because 0.01 lot size effectively controls $1000 when you now have only $500 (you are now using a leverage of 2:1 respective to your account size). In fact, because of the 200:1 leverage potential, your account can fall below $100 (90% of your initial), and you can still be using 0.01 lot size to try to get you out the hole. The greater leverage capacity is thus allowing you to maintain your initial lot sizing as your account drops. Compare that to stocks, where every percentage decline in your account would force you to trade 100 block shares of smaller and smaller stock values, which would make it harder and longer to climb your way out of your drawdown.

In the end, your brokerage leverage determines your maximum potential leverage, and it is in your best interest to trade the smallest degree of it, reserving the rest for plays of diversification, opportunity and hardship.

Margin, Used Margin and Free Margin

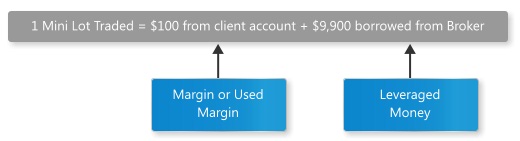

At the beginning of the article, we illustrated how a client with a $1000 account (the initial balance) buys 1 mini lot of EUR/USD, which has an operational worth of $10,000. Supposing the client has a leverage of 100:1 for that account, then in order to trade that 1 mini lot he would take $100 from his account and borrow $9,900 from the broker. The money he takes from his account ($100) is the margin or used margin, which is being used to maintain the open trade position. There is now $900 in his account that is not being traded. The capacity to make another trade is determined by the free margin which is the equity from which the currently used margin is subtracted.

Margin

Margin or Used Margin

The amount of money in your account that is currently used in open trades.

If you have 100:1 brokerage, and you have opened up 1 mini lot, then your used margin is $100. See table above: Leverage / Margin Requirement Table for Various Lot Sizes. More precisely, the formula is as follows:

Used Margin = (Market Quote for the pair * Lots) / Leverage

(Example of 200:1 broker for 1 mini lot at 1.2700 EURUSD:

(1.2700 * 10,000) / 200 = $63.50

In order to open & retain your trade, you’ll need to have at least $63.50 of the available equity on the account.

Usable or Free Margin:

It is the amount of money in your account minus the margin (or used Margin).

If you have $1000 in your account and you have opened up 1 mini lot that requires a margin of $100, then your free margin is $900.

Free Margin = Equity – Margin (or Used Margin)

(Example: $1000 – $100 = $900 free margin)

Below is an MT4 screenshot of Margin, Free Margin and Margin Level (in Terminal Window):

We have already discussed what Margin and Free Margin is. In the above 400:1 FXPro account of $1399, we took out a mini lot that is using $25 margin. That leaves $1371 free margin available to me for additional trades. Ok, then, what is Margin level (what is that 5504%)?Margin Level Percentage:

Margin Level Percentage = (Equity / Margin) X 100

In the above screenshot, the equity is $1397 divided by 25 equals 55, and multiplying by 100, gives 5504% margin level percentage. What is the meaning of this? It gives you a quick visual of your level of margin, particularly how close you are to reaching 100% margin level, the typical level that once reached for many brokers will result in a margin call liquidation. Let us break down the above screenshot:

Balance: 1399.22

Equity: 1397.32

Margin: 25.39

Free margin: 1371.93

Margin level: 5504.38%

I am using $25 margin. For a 100% Margin Call Broker, I will receive a margin call liquidation when the equity falls below $25 (100% margin level).

What is a margin call?

Whether trading stocks, futures or Forex, all traders fear the dreaded margin call.

Margin Call: a warning from a broker that your account has slipped past the required margin in %, and that there is not enough equity (floating profits – floating losses + unused balance) on the account to support your Open trades any further.

From the broker’s point of view, it is their way of protecting themselves from losing the money they had granted you via margin and leverage. In Forex it is not a call from your broker to add more funds, as it is with stocks and futures. Instead, it is usually an automatic full or partial liquidation of your positions when the account falls below the maintenance margin (capital required to open a position, for example, $1000 for a standard lot when using 100:1). See table above. The greater the leverage used on any particular trade, the more risk capital you have at risk, and the more likelihood of a margin call.

You should fully understand how your margin works, and be sure to read the margin agreement between you and your broker. It is always a good idea to keep an eye on your Used Margin and Free Margin to ensure you are not using too much margin and that you have plenty of free margin left.

When the broker says: Margin Call level = 100%.

This means that once Margin level is 100%, you will get a margin call liquidation (with maybe an email warning beforehand) when your equity equals your used margin, that is when your margin level is 100%. Soon after your positions will be closed out (usually one by one, starting from the least profitable until the minimum margin requirement is met). While a 100% margin requirement makes a risk of margin call much closer, it does save more money when further losses are inevitable by preventing you from losing your shirt. You have at least some money left in the account in an extreme adverse market move.

When the broker says: Margin Call level = 50%.

This broker is being very generous as to how it handles your abuse of margin limits. It will only start liquidating your account when your equity equals half your used margin, that is when your margin level goes down to 50%.

When the broker says: Margin Call level 70%, stop out 30%

This broker is being extra generous and giving you a fair warning. A margin call warning is initiated when your margin level goes down to 70%, and liquidation occurs when your margin level goes down to 30%. By having your margin call level set at these lower levels, your risk of having a margin call is pushed further away (which can be good if you are trading with grid or martingale systems). However, if you are not careful enough, these more generous margin call brokers can leave you with very little left in your account if the market moves strongly against you.

Below is an example of a margin call with a 100% Margin Call Level Broker.Example

Jeff opens a micro account with $1000 at 100: 1 leverage. He analyzes the EUR/USD and decides to go short, entering 4 mini lots on EUR/USD at the price of 1.3200. According to the margin formula above [(Market Quote * Lots) / Leverage], Jeff would be using $520 margin ((1.3200 *40000)/100). Before entering, Jeff’s free margin was $1000, and after entering, his free margin is $480 ($1000-$520).

Disaster strikes and Jeff’s trades go against him: EUR/USD jumps up 100 pips, and since every pip with 4 mini lots equals $4, his equity drops down to $400 (150*$4) to reach $600 (1000-400). Now Jeff sees that his Margin Level is 115% (Equity / Margin= $600/$520), dangerously close to his 100% max margin level. At this point, his margin bar has turned red as a warning. When the EURUSD jumps up another 25 pips, his account equity drops down $100 (25*$4) to reach $500. Now he has reached below 100% max margin level and the system automatically closes trades at a loss to recover more margin.

When things get close to 100%, a number of things can happen, depending on the margin policy of the broker. Some brokers can liquid positions at 100%. Depending on the margin policy of the broker, his positions could have been totally or partially liquidated. Since Jeff has a 100% margin call level policy with his broker with partial liquidation procedure, his broker starts to auto-liquidate positions (largest loses first) till his account moves back above the 100% margin call level. At first, he might see that one of his four positions be stopped out at 125 pips loss, lowering his margin requirement down to $390 (for a $500 equity), which resets his margin level to 128%.

But if the market falls by an additional 25 pips, he would see his account go down by $75 (25*$3) to $375 equity, which again pushes him beneath the 100% max level, and he would end up losing a second position at 150 pips loss. This would, in turn, lower his margin requirement down to $260, and with $375 equity, his margin level would be reset to 144%. Perhaps then, seeing that he has lost over 60% of his original, Jeff would call it quits and close out the last two positions with -150 pips loss each, for a grand total loss of $ 625.

Poor Jeff, he took advantage of too much leverage and got himself in trouble. Ideally, Jeff should have been trading with only 2:1 leverage, which would have been 2 micro lots for his $1000 account (2 micro lots=$2000). Then a 150 adverse move against him would have cost him only $30 (150*$0.20), a loss of only 3% of his account. Jeff would then be able to fight another day.

How to avoid Margin Calls & Stop Outs?

- Use smart leverage. Try not to trade more than 2:1 leverage at any one time.

- Prudent capitalization. Make sure you have sufficient funds to open and maintain trades.

- Reduce your risks. Try not to risk more than 3% of your account on any one trade.

- Place stops to protect your equity from significant losses.

Ultimately, margin calls can be effectively avoided by using far less than available leverage to make your trades and monitoring the account balance on a regular basis. It has often been suggested that one should use stop-orders on every position to limit risk, and these can be helpful, but keeping the leverage size low relative to your account balance is the best money management strategy.

Conclusion

Most successful traders are careful, cautious, and objective when analyzing the market and seeking a trading opportunity. They rarely use more than 2:1 leverage, they always use reasonable stop losses and they use effective lot sizing models.

Novice traders, no matter how well schooled and prepared, often commence their career with a shaky start. They soon realize that not every trade makes money, and in fact most trades lose. Winning and losing trades often come in streaks, with more losing streaks than winning streaks. For a while everything works out, and then all trades turn sour. It is extremely important that you do not get too confident with a couple of winners, or get too despondent with a series of losing trades.

There are some common mistakes that the rookie trader makes. The biggest mistake is trading too big for the size of the account. If a move against you of 50 pips or less is going to cause you to liquidate your position or worse yet, the margin clerk does it for you, then you are trading too big. For new traders, it is generally better to trade a smaller unit size with a wider stop.